You are here

Bachelor of Science (Honours) in Actuarial Studies

|

|

|

APU-DMU DUAL DEGREE PROGRAMME Students who are under Bachelor’s Degree Programme will have the option to opt-in for the APU-DMU Dual Degree Scheme. Under this Scheme, students will receive 2 Degree Certificates & Transcripts upon graduation: 1 from Asia Pacific University (APU), Malaysia and 1 from De Montfort University (DMU), UK. |

ADMISSION REQUIREMENTS

GENERAL REQUIREMENTS | |

| DIRECT ENTRY TO LEVEL 1 OF THE DEGREE: | |

| STPM | • 2 Passes in STPM with a minimum Grade C+ (GP 2.33) and a Credit in Mathematics and a Pass in English at SPM Level or its equivalent. |

| A-LEVEL | • 2 Passes (Grade A-D) in A-Level in any 2 subjects, and a Credit in Mathematics and a Pass in English at SPM/O-Level/ IGCSE or its equivalent. |

| UEC | • 5 Grade B’s in UEC including Mathematics with a Pass in English. |

| MATRICULATION/ FOUNDATION | • Passed Foundation programme (minimum CGPA of 2.5) with a Credit in Mathematics and a Pass in English at SPM/O-Level/IGCSE or equivalent. |

| ENGLISH REQUIREMENTS | |

INTERNATIONAL STUDENTS | • IELTS : 6.0

|

PROGRAMME OUTLINE

This programme is specifically designed to provide students with:

- A course of study in Actuarial Science which has been awarded full accreditation by IFoA (UK).

- Competent teaching staff with professional or specialised academic qualification, possessing working experience from actuarial industries/academia.

- Course syllabus which is comprehensively structured in tandem and compliance with the 2 biggest actuarial bodies, the IFoA (UK) and the SOA (US).

- Comprehensive guidance to mould graduates to be industry-ready.

DEGREE LEVEL 1 |

Equipping students with essential fundamentals of Mathematics, Statistics, Economics and Finance starts at Level 1. To complement the core knowledge, the students will also learn Business, Communication, and IT skills, before progressing to the Level 2 of Actuarial Science study.

COMMON MODULES | |

|

|

DEGREE LEVEL 2 |

The core knowledge of Mathematics and Statistics now act as engine to drive the complex models of Economics and Finance in the actuarial industries. Those core knowledge are integrated to form actuarial tools and infrastructure, ready to be used for planning and managing purposes. Students will receive exposure and coaching which are actuarial centric, targeting at industrial applications. They are gradually groomed to be more independent in their study and research efforts.

COMMON MODULES | |

|

|

INTERNSHIP (16 WEEKS) |

Students will undertake a short Internship/ Industrial Training for a minimum period of 16 weeks to prepare them for a smooth transition from the classroom to the working environment.

DEGREE LEVEL 3 |

The students are now ready to merge their knowledge and industrial experience to forge ahead and put into action their acquired skills in planning, managing and analysing risk. At this level, emphasis is placed on evaluating financial performance of businesses from actuary’s perspectives. Students will have the opportunity to understand the critical roles played by actuaries, for example, in the development and pricing of insurance products. Risk Management, Actuarial Modeling and Ratemaking are some of a wide repertoire of skills to be used.

COMMON MODULES | |

|

|

MQA COMPULSORY SUBJECTS* |

|

|

(*All students are required to successfully complete these modules as stipulated by the Malaysian Qualification Agency.) | |

CAREER OPTIONS

|

|

PROFESSIONAL RECOGNITIONS

APU’s Bachelor of Science (Honours) in Actuarial Studies is a 3-year degree programme of full-time study. This programme is to develop students’ mathematical, statistical and analytical skills in addition to actuarial practices as preparation to become a qualified actuary.

Actuaries are highly regarded professional and they work across several industries including life and general insurance, commercial and investment banking, pensions and healthcare, consulting firms, and public sector. Actuaries are problem solvers and strategic thinkers with a deep understanding of risk management; they are one of the top paying professionals as they are usually in high demand worldwide.

APU’s Bachelor of Science (Honours) in Actuarial Studies offers Double the Advantage with a Dual Award from De Montfort University (UK), worldwide recognitions from IFoA, SOA and CAS to attain associateship and fellowship and enrich global community.

| |

INSTITUTE AND FACULTY OF ACTUARIES (IFoA) UK

Full IFoA Accreditation

APU's Bachelor of Science (Honours) in Actuarial Studies including the two specialisms are fully accredited by the Institute and Faculty of Actuaries (UK).

Our graduates who attain an average of 65 or above can be eligible for block exemptions from CS1, CS2, CM1, CM2, CB1 and CB2 in the new IFOA curriculum.

In November 2023, 100% of APU actuarial graduates (APU/APD3F2209ACS) received exemptions from CS1, CS2, CM1, CM2, CB1 and CB2. Congratulations to those who received maximum IFOA exemptions!

For more information, please visit: https://www.actuaries.org.uk/studying/exam-exemptions/university-courses-exemptions/asia-pacific-university-malaysia

IFoA Foundation Scholarship

APU is one of a few IFOA’s partner universities in Asia to secure major IFOA scholarships for its students pursuing actuarial studies. Every year, the top five graduates will receive the Foundation’s Scholarships (worth £4490) awarded by the IFOA. In addition, the best among the five will also receive the Sir Edward Johnston Prize (worth £250) awarded by the IFOA. Click HERE to read more information.

PATHWAY TO IFoA ASSOCIATESHIP AND FELLOWSHIP

SOCIETY OF ACTUARIES (SOA), USA

APU is also recognised by the Society of Actuaries (US) that our Bachelor of Science (Honours) in Actuarial Studies will prepare students for all the six preliminary exams (P, FM, IFM, LTAM, STAM, and SRM) in the new SOA curriculum. This is in addition to the approved coursework for all the three VEE topics (Accounting & Finance, Economics, and Mathematical Statistics).

For more information, please visit: https://www.soa.org/institutions/Asia-Pacific-University-of-Technology-Innovation.aspx

PATHWAY TO SOA ASSOCIATESHIP AND FELLOWSHIP

CASUALTY ACTUARIAL SOCIETY (CAS), USA

CAS University Recognition Program

APU is also recognised by the Casualty Actuarial Society at the Silver Level of the CAS University Recognition Program. Our Bachelor of Science (Honours) in Actuarial Studies will not only prepare students for Exam 1, Exam 2, Exam MAS-I, Exam MAS-II and Exam 5 in the new CAS curriculum but also effectively prepare them for careers in the general insurance industry. With this achievement, APU joins a distinguished list of internationally recognised universities with exceptional actuarial studies programmes.

For more information, please visit: https://www.casact.org/university-programs/cas-university-recognition-list

About the CAS

With 10,000+ members working in more than forty countries, the CAS is the global leader in the credentialling and education of general insurance actuaries.

CAS members work in a vast array of settings, including insurance companies, educational institutions, state insurance departments, federal government agencies, independent consulting firms, and many other organizations that require management of risk. Learn more at www.casact.org.

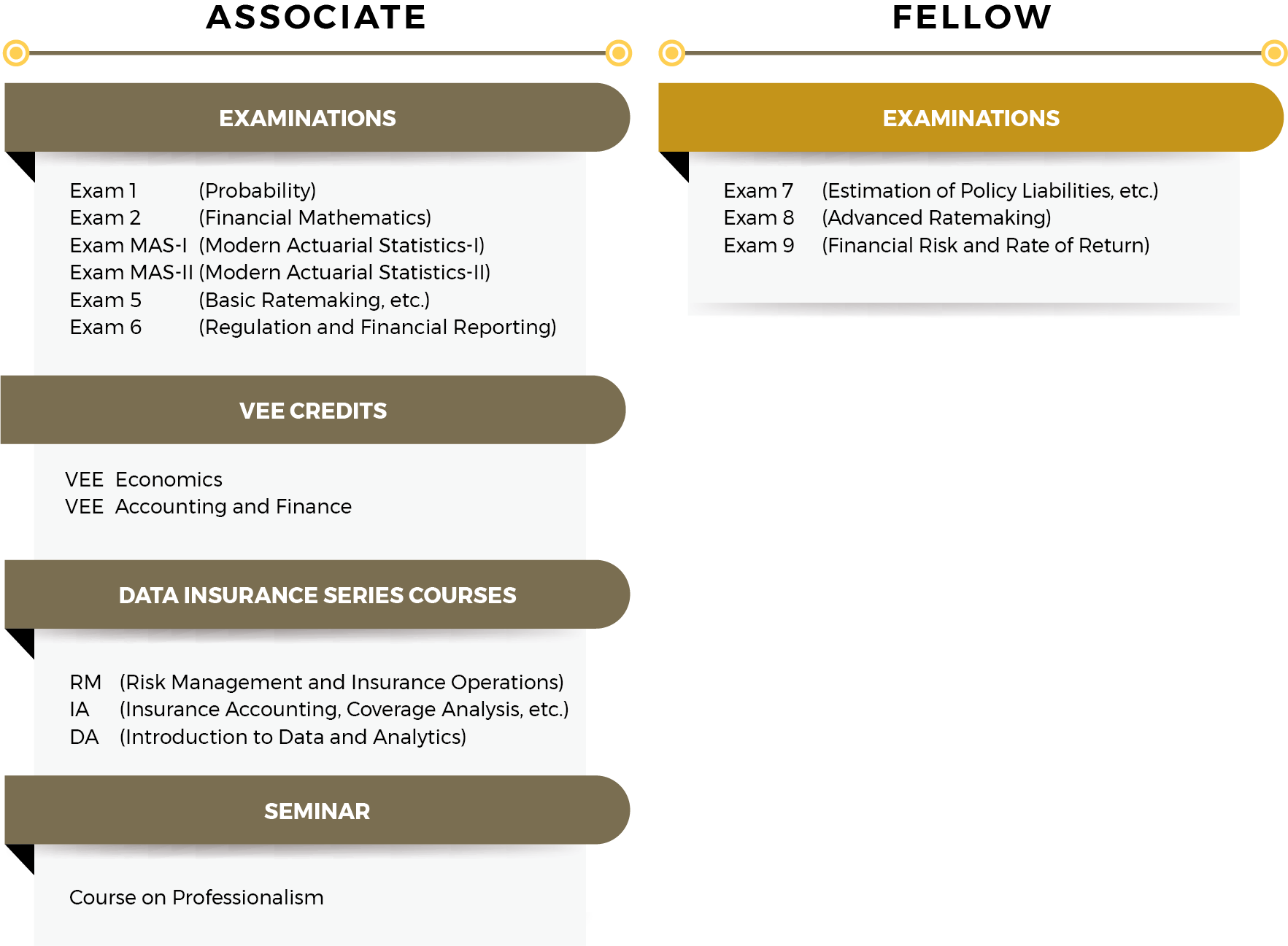

PATHWAY TO CAS ASSOCIATESHIP AND FELLOWSHIP

COURSE FEES

Malaysian Students | International Students |

Year 1: RM 29,600 | Year 1: RM 32,000 (USD 7,270) |

* Fees stated here do not include Deposits and other Miscellaneous Fees. Please refer to Fee Guide for details.

MQA ACCREDITATION

(R2/462/6/0003)(06/27)(MQA/FA1327) |

| All information is correct at the time of publication, but is subject to change in the interest of continuing improvement. |

Bachelor of Science (Honours) in Actuarial Studies Programmes | |