You are here

Accounting, Banking, Finance & Actuarial

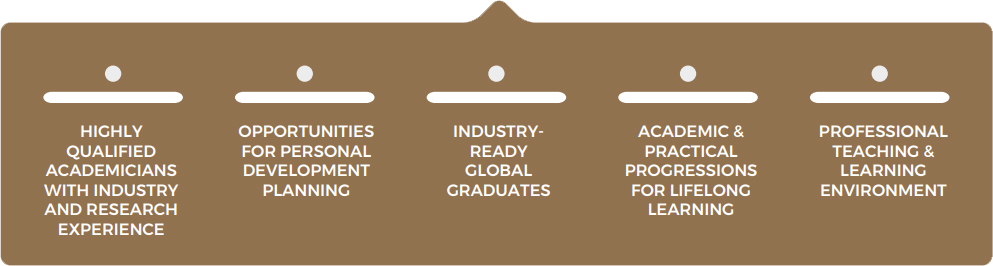

APU's Accounting, Banking, Finance & Actuarial programmes are excellent springboards for individuals who wish to launch a professional career. The programmes are well established, and is designed to provide a thorough understanding of the principles and practices of accounting, banking, finance, actuarial and related subjects. Students on the course have the flexibility of developing and building their specialist knowledge whether in industry or public service. The awards cover an in-depth knowledge of the core areas, equipping students with necessary skills for the future. The primary objective of these programmes is to develop knowledgeable and capable students to enable them to secure key positions in the financial services sector.

The Aims of the APU Accounting, Banking, Finance & Actuarial Programmes are to:

- Provide you with a rewarding yet challenging learning experience to enable you to be a high quality graduate with the knowledge, skills and understanding for an effective and valued career.

- Enable you to undertake employment in industry, commerce or public service as professionals by developing your capabilities in relation to innovation, integration of ideas and concepts, interactive development, information provision and imaginative approaches to processes and problem solving.

- Provide you with a Personal Development Planning opportunity in relation to enhancing your employability through increasing your independence, inventiveness, ingenuity and developing your all round intelligence in relation to solving problems, decision making, working with other people and communication skills.

- Facilitate your progression, both academic and practical, by means of developing knowledge, key skills and a capacity for independent and lifelong learning.

- Enable you to specialise in depth in areas corresponding to your ability and choice.

| The Five "I"s Model | |

1: INNOVATION | through the design of curriculum, the module content and the learning approaches |

2: INTEGRATION | through developing your capabilities to interrelate knowledge and to work in multidisciplinary teams |

3: INFORMATION | through developing your knowledge and also your abilities to communicate effectively and persuasively |

4: INTERACTIVITY | through the use of group work to develop your teamwork skills and through the use of technology to achieve interactivity of devices and people |

5: IMAGINATION | in relation to new products, ideas, applications and solutions |

Accounting & Finance Programmes:

The Bachelor of Accounting and Finance (Honours) is an excellent springboard from which to launch a professional career in accountancy or to pursue further study. It is well-established and is designed to provide a thorough understanding of the principles and practice of accounting and related subjects. The award covers an in-depth knowledge of the core areas for those intending to move into the Accounting profession as well as those specialised areas such as tax, forensic and investment.

The Accounting and Finance programmes at APU are excellent springboards for students to launch their professional careers in accountancy or finance or to pursue further studies. They are well established, and are designed to provide a thorough understanding of the principles and practices of accounting, finance and related subjects. These programmes are well-accredited by professional bodies such as ACCA, CIMA, CPA, CTIM, ICAEW and more.

Upon completion, students are eligible for exemptions from the below Professional bodies as our Accounting and Finance degrees are accredited by them:

| ACCA - 9 papers exemptions out of 13 papers |

| CPA - 6 papers exemptions out of 12 papers |

| MICPA Professional Stage Examination |

| ICAEW - 8 papers exemptions out of 15 papers |

| CTIM - 5 papers exemptions out of 8 papers |

CIMA - Eligible to start at Management Level through the CGMA® FLP programme. |

Also, Diploma in Accounting are eligible for 3 fundamental modules exemption from ACCA.

AccTech for the Future

Powered by AccTech - All Accounting & Finance Programme comprise modules in AccTech. |

As the business landscape continue to shift, the accounting profession too must be able to adapt. Accounting technology is revolutionising the field by replacing paper-driven processes with efficient cloud-based solutions, allowing for 24/7 access and greater flexibility.

Today, firms are using accounting technology and cloud-based platforms for automation, sophisticated diagnostics, and predictive analysis, resulting in improved client service and more effective utilisation of knowledge.

Our university’s modules in accounting technology are designed to equip our students with the skills and knowledge to excel in today’s fastpaced business environment, positioning them at the forefront of the industry with access to many benefits of accounting technology.

Futuristic : [ Advancements ] powered by ACCTECH

FinTech for the Future

Powered by FinTech - All Banking & Finance Programme comprise modules in Financial Technology (FinTech). |

Financial Technology (FinTech) is gaining momentum year-on-year and is creating a huge demand for professionals with specific FinTech skills. Traditional accounting and finance industry is getting digitally transformed. To cater to the skill gap in the Financial Services, a sound knowledge on technology application has become an essential part of the graduate skill.

Traditional financial institutions and FinTech start-ups are looking for more candidates who specialise in artificial intelligence, machine learning and data science. According to a report by Bloomberg reporting and data from LinkedIn[1], job listings requiring these skills in the financial industry increased nearly 60% in the past year. APU Banking & Finance programmes are designed to cater to the increased demand for finance graduates with FinTech skills.

Futuristic : [ Advancements ] powered by FINTECH

Banking & Finance Programmes:

Our Bachelor in Banking and Finance (Hons) is an ideal and outstanding programme for those who wish to engage in financial services industry or government sectors, particularly in banking and central banking. Students on the course also have the flexibility of developing and building their specialised knowledge in areas such as in Financial Planning as well as Investment & Risk Management.

There is high global demand for well-trained Banking & Finance individuals in banking, finance, education, as well as government sectors. Career options may include:

|

|

|

Finance is always at the heart of commerce that no one could get rid of. However, the advent of financial technology has disrupted the delivery of financial services. In order to remain competitive in digital banking sphere, banks have started to employ more staffing resources in the digitisation initiatives. Thus, our Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology (one of the first industry-driven FinTech curriculum in Malaysia) will prepare the graduates to meet the needs of a rapidly disrupted Financial Services industry in Malaysia and internationally with the ability to develop innovative ideas and to employ state-of-the art technologies.

All Banking & Finance Programmes are accredited by Professional Body Partner:

| Asian Institute of Chartered Bankers (AICB) |

| All the graduates of Banking and Finance are eligible to be affiliate members of CISI at a discounted price. Affiliate members of CISI will enjoy a suite of benefits, encompassing networking opportunities, continuous professional development, access to resources, and a commitment to ethical standards and professional excellence. |

| LSEG Financial Database |

All Banking & Finance Programmes are empowered by Industry Collaboration:

| FAOM |

Professional Recognitions

APU has been leading the way for its graduates in Professional recognition and exemptions in the areas of Accounting, Banking, Finance and Actuarial Studies. These are valuable not only for moving your career as a full-time professional forward but also for expanding your skills and expertise to become a more well-rounded employee. These recognitions help you become a more desirable job candidate or employee, one who can command a higher salary.

| Chartered Financial Analyst (CFA) Institute University Affiliation Program |

| CMT Association Partner Academic |

Actuarial Studies Programme - Worldwide Accreditation by IFoA, UK and SOA, US:

APU’s Bachelor of Science (Honours) in Actuarial Studies is a 3-year degree programme of full-time study. This programme is to develop students’ mathematical, statistical and analytical skills in addition to actuarial practices as preparation to become a qualified actuary.

Actuaries are highly regarded professional and they work across several industries including life and general insurance, commercial and investment banking, pensions and healthcare, consulting firms, and public sector. Actuaries are problem solvers and strategic thinkers with a deep understanding of risk management; they are one of the top paying professionals as they are usually in high demand worldwide.

APU’s Actuarial Studies programme is widely recognised by the Society of Actuaries (SOA), US and Institute of Faculty of Actuaries (IFoA), UK. Be a part of the fast-growing Actuarial industry with us; APU is also listed amongst the top Asian universities to receive maximum block exemptions at IFoA.

APU’s Bachelor of Science (Honours) in Actuarial Studies, Bachelor of Science (Honours) in Actuarial Studies with a specialism in Data Analytics and Bachelor of Science (Honours) in Actuarial Studies with a specialism in Financial Technology are Accredited by Programme by the Institute and Faculty of Actuaries (UK). Our graduates who attain an average of 65 or above can be eligible for exemptions from CS1, CS2, CM1, CM2, CB1 and CB2 in the new IFOA curriculum.

In 2022, 83% of APU graduates received exemptions from CS1, CS2, CM1, CM2, CB1 and CB2. Congratulations to those who received maximum IFOA exemptions!

For more information, please visit

https://www.actuaries.org.uk/studying/exam-exemptions/university-courses-exemptions/asia-pacific-university-malaysia

| |

Professional Recognitions

| APU's Bachelor of Science (Honours) in Actuarial Studies including the two specialisms (Data Analytics and Financial Technology) are fully accredited by the Institute and Faculty of Actuaries (UK). |

| APU is also recognised by the Society of Actuaries (US) that our Bachelor of Science (Honours) in Actuarial Studies including the two specialisms (Data Analytics and Financial Technology) will prepare students for all the six preliminary exams (P, FM, IFM, LTAM, STAM, and SRM) in the new SOA curriculum. This is in addition to the approved coursework for all the three VEE topics (Accounting & Finance, Economics, and Mathematical Statistics). |

| APU is also recognised by the Casualty Actuarial Society at the Silver Level of the CAS University Recognition Program. Our Bachelor of Science (Honours) in Actuarial Studies will not only prepare students for Exam 1, Exam 2, Exam MAS-I, Exam MAS-II and Exam 5 in the new CAS curriculum but also effectively prepare them for careers in the general insurance industry. With this achievement, APU joins a distinguished list of internationally recognised universities with exceptional actuarial studies programmes. |

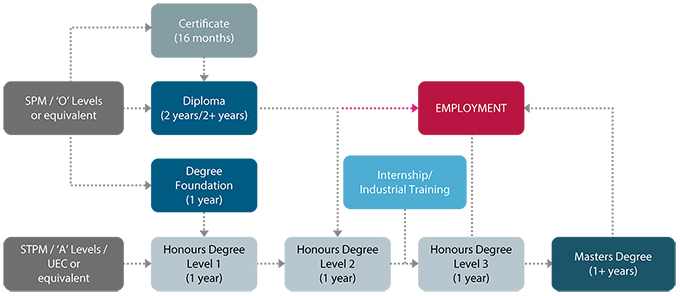

Internship / Industrial Training

A well-structured internship or industrial training programme in collaboration with industry is incorporated into the curriculum. The main objective of the internship programme is to further enhance your employability. In many cases the same company at which you had internship/industrial training will offer you employment as soon as you graduate. In all cases you will gain an invaluable insight into the world of business and management practices and be better equipped to position yourself for the career you seek.

Accounting, Banking, Finance and Actuarial Programmes |

- Bachelor of Accounting and Finance (Honours)

- Bachelor of Accounting and Finance (Honours) with a specialism in Forensic Accounting

- Bachelor of Accounting and Finance (Honours) with a specialism in Forex and Investments

- Bachelor of Accounting and Finance (Honours) with a specialism in Accounting Technology

- Bachelor in Banking and Finance (Hons)

- Bachelor in Banking and Finance (Hons) with a specialism in Investment Analytics

- Bachelor in Banking and Finance (Hons) with a specialism in Financial Technology

- Bachelor of Science (Honours) in Actuarial Studies

- Bachelor of Science (Honours) in Actuarial Studies with a specialism in Data Analytics

- Bachelor of Science (Honours) in Actuarial Studies with a specialism in Financial Technology

Undergraduate Study Areas: